Explore how the Fit for Purpose (F4P) framework can bring real benefits for your business and help you focus on what is really important for your clients.

Getting more revenue while reducing cost: who doesn’t want that?

During the last few decades, we’ve started to see a shift in the market: up to the 90s, improving corporate processes and doing more with less was the name of the game. Steady, linear growth was the recipe for business success. However, as the 2000s rolled in, something changed: big fish are no longer able to simply eat smaller or faster fish, and the startup phenomenon rendered linear growth outdated. Exponentiality was the new deal.

Part of the startup magic is about gauging new needs, learning, and adapting fast. This is possible in a company of any size. However, you can be sure that you can learn fast only when you have the right tools and mindset in place to do so. Now imagine you hear this from a sixty-year-old board member from a nearly century-old firm:

“I had always found it difficult to understand what you meant by delivering value to customers early, and making a low-cost-high-value impact, but once you explained about F4P, I can do that every day”.

Getting that sort of feedback is priceless. And that’s what F4P can do for you.

The first issue with big corporations is that they move slowly. And they move slowly due to a natural need for security and risk assessment. So, any idea has to go through too much trouble in order to simply be tested. The result is that a lot of investments are made and a lot of time and money wasted before we realize what we’ve built isn’t really going to fulfil our customer’s purpose.

Does that mean we should just try stuff without assessing risk? Not at all. We can use the 3 components, one of F4P’s many tools, to direct quick, low-risk-high-impact tests in a controlled environment, and metrics to decide if more investment is worth it.

We saved over US$1MM using F4P framework

In one of the companies where we applied F4P, we saved over US$1MM just by removing from the project scope everything we hadn’t tested in service delivery. In a single test, we managed to create a new revenue stream with a 20% conversion rate. All we did was, instead of treating an apparent frivolous customer request as a problem, we went deeper and tested if a small sample was willing to pay for it as a service. 80% of them found out they could receive some guidance and do it themselves, while 20% happily paid for the service. This was a zero-cost increase in revenue, validated over 2 weeks!

The same applies to the F4P approach on metrics: in most companies, strategy governance is executed based on lagging metrics. Things like EBIT, revenue, and stock… are all paramount for running a business and making sure it’s healthy but they are not predictive of customers’ behavior. As a business leader, you end up trying to sense and respond to whatever your competition is doing. You feel you can’t innovate or be the first to explore a market opportunity. The reason that happens is that you are making future decisions based on past performance, but not the future demand. F4P Key Performance Indicators focus on predicting customers’ behavior to empower you to position your business aiming for the near future.

Using F4P cards to map out market opportunities

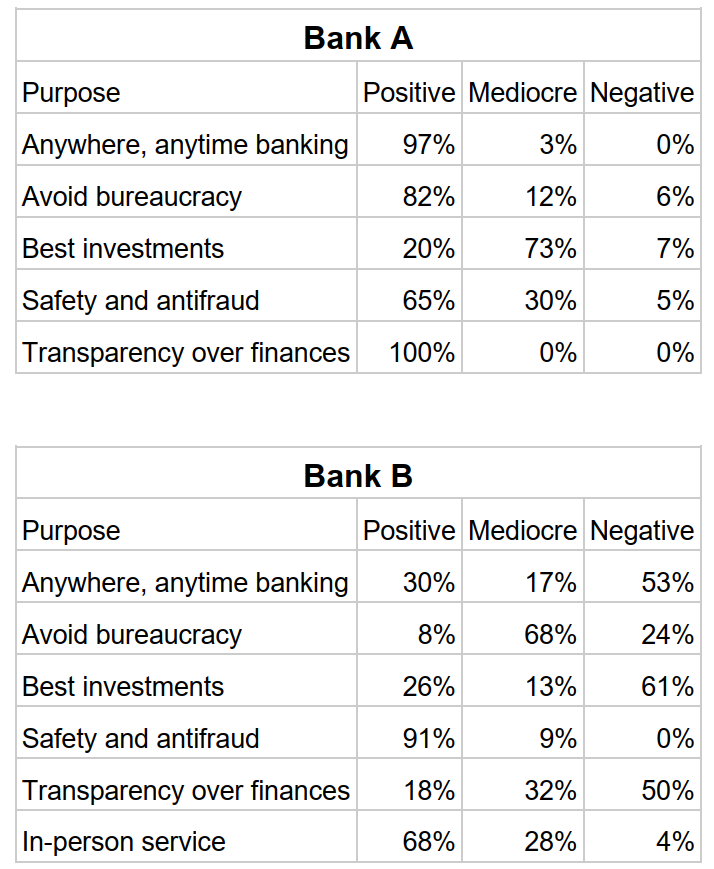

Mapping out those market opportunities and even assessing your competitors’ strengths and weaknesses is no easy feat. Or is it? You can quickly address that with F4P Cards, enabling a data-driven approach to this analysis. Let’s take a look at the example below, extracted from the F4P Cards responses for two different banking companies:

Bank A is a startup, while Bank B is a traditional, well-established corporation. Recently, there have been large investments to update Bank B’s in-person service and its anti-fraud policies. And that would be great if Bank B hadn’t been losing a vast number of clients to Bank A. If it is Bank B’s strategy to contain churn (a lagging metric), they must understand what is predictive of churn. In their case, there are some items, like:

- The number of times a client must call or go in person to a bank to solve a problem.

- The duration of the call or visit that the client gets to go through.

- The number of times the clients couldn’t do a transaction when they wanted because they had to wait until business hours.

These are predictive of the customers’ behavior metrics. If it’s something recurrent, they end up thinking “Bank A is new and so on, but at least I will be able to do things faster”. At this point, they will be willing to accept a little more risk fraud-wise in order to receive more convenience. If they don’t address that issue, all funds invested in their projects become a waste of resources: they are not investing in the levers that will definitely make a difference.

Conclusion:

Innovation is not creating a product out of nothing. Innovation is a discovery of an unfulfilled purpose and finding new ways to fulfil them while making loyal, happy customers. If you run a business, product, or service and you don’t yet have all your customer’s purposes mapped out so you can make decisions based on leading numbers, I would like to invite you to get to know F4P and how it can improve your strategy.

Authors:

Andressa Chiara - Strategy Specialist & Partner, K21, Brazil

Marco Dubovski - Executive Product Manager at Serasa Experian, Brazil

Learn more about F4P Framework:

- Create your free account on F4P Plus to explore the framework.

- Download free posters or book extract.

- Buy the F4P 3rd edition book.

- Go through a self-paced learning course.